There is misconception around the Muslim community about charging interest for loans by the financial institutions to be unlawful as some of Islamic scholars consider usury and interest are the same. It would be unjust if there is no provision for fall in purchasing power of money with the lapse of time and also for reasonable yield if the lent amount were to be invested in some business venture instead of loan.

God has told us every detail of the usury in the Quran to understand it to be unlawful as well as to make a difference between usury and interest. The Arabic word “Riba” in the Quran is translated in English as ‘usury’ by many translators and as ‘interest’ by few while there is a distinction between usury, which is “Riba” and interest, which is “Fa’eda” in the Arabic language. The Quran forbids usury but not interest. However, in the Arabic language, “Riba” literally means an “increment” or “excess” but in essence, it means unfair advantage or profiteering. Thus, usury can be defined as an excessive or inordinate premium for the use of money borrowed, or in other words, it is the practice of taking exorbitant or excessive interest on loan.At best Riba can be treated as usury, which is unjust, excessive and exploitative increase on loan, is condemned with stern warning in the Quran.

Usury in the Quran

God has prohibited Riba (usury) with severe warning, which has been spelled out in the following verses of the Quran:

[2:275] Those who consume the usury (al-riba) do not stand except like that the one who confounds him from the touch of the Satan. That is because they said, “Indeed, the trade (al-bay`u) is like the usury (al-riba)”, while God has permitted the trade (al-bay`a) and has forbidden the usury (al-riba). So whomever has come to him an admonition from his Lord, then he has refrained, then for him what has passed and his matter is upon God; and whoever has repeated, then those are companions of the Fire – they will be dwellers in it.

[2:276] God denounces usury (al-riba) and blesses for the charities. God does not love every ungrateful sinner.

[2:278] O you who have believed, you shall fear God and give up what remained of the usury (al-riba) if you are believers.

[3:130] O you who believed, you shall not consume the usury (al-riba) for multiplying doubled, And you shall fear God that you may succeed.

[4:161] And of their taking usury (al-riba) but they were certainly forbidden from it and of their consuming wealth of the people unjustly, and we have prepared for the disbelievers amongst them a painful retribution.

[30:39] And what you lend for usury (riban) to increase in wealth of people will have no gain with God. But what you give to the charity seeking His pleasure, then those will get manifold.

Mathematical confirmation

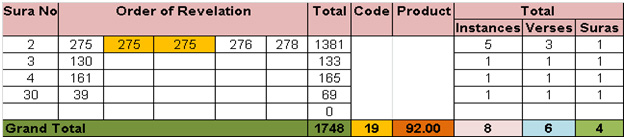

The commandment of prohibition of usury is very simple as stated in a small set of verses in the Quran, even God has blessed us to mathematically confirm it. There are 8 instances of riba (usury) in 6 verses across 4 suras of the Quran and if the relevant sura and verse # are added, the total is a multiple of 19 => 1784 = 19x92 (see details below):

Note: There are 3 instances of riba in the verse 2:275 which are included in the mathematical confirmation of the commandment of prohibition of usury while the mathematical confirmation is on the basis of the single instance.

However, there are also additional verses in the midst of usury indicating warning not to involve in practicing of usury while the believers are commanded to lead a righteous life encouraging them becoming more charitable:

[2:277] Indeed, those who believe and lead a righteous life, and observe the contact prayer (Salat) and give the obligatory charity (Zakat), they deserve their reward with their Lord and they will have nothing to fear, nor will they grieve.

[2:279] And if you do not (do that), then be aware of a war from God and His messenger. But if you repent, then for you it will not be wrong to have your capital back nor will you wrong.

[3:131] And you shall fear the Fire which is prepared for the disbelievers.

[30:38] Therefore, you shall give the relative his due as well as the poor and the wayfarer. That is better for those who seek God’s pleasure, and those are the winners.

Mathematical Confirmation

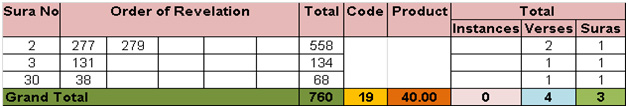

Even the above verses that are not part of the core command can also be mathematically confirmed. There are references in 4 verses across 3 suras where the instances of Riba found in other verses of those suras and if the relevant sura and verse # are added, the total is a multiple of 19 => 760 = 19×40 (see details below):

Business transaction

The Quran has prohibited usury while it does not say that one may not borrow or lend money to and from a friend or relative and even charge interest. Instead, if such transaction occurs must be in writing with detailed terms and conditions having appropriate witnesses, which may involve interest, to at least pay for the cost of the loan to the lender if any, and compensate for any change in the value of the currency over the time of the loan, but should not involve usury. Here are the verses on the business loan, even at individual level with instructions of necessary adjustments based on circumstances of the borrowers:

[2:280] If the debtor is unable (to repay),then you shall wait until he becomes able. And if you give up as a charity, it would be better for youif you only knew.

[2:281] And be aware of a day when you will be returned to God then every soul will be paid what it has earned, they will not be wronged.

[2:282] O you who believe, when you contract with one another a debt for a fixed term, then you shall write it. And let a scribe write with impartiality. And a scribe shall not refuse to write as God has taught him. So let him write and let the one who is to repay dictates and let him fear God, his Lord and not to diminish anything from it. Then if the one who is to repay is not knowledgeable or weak or cannot dictate, then his guardian shall dictate with impartiality. And have two witnesses from among your men. And if there are not two men, then a man and two women whom you accept as witnesses that one of the two errs, then the other of the two will remind the other one of the two. And the witnesses should not refuse when they are called. And do not feel tiredas you write its term whether small or large. That is more just with God and better for evidence and better that you do not have any doubt, except that be a transaction done on the spot among you, then there is no sin on you not to write it. And have witnesses when you deal with business transaction. Neither scribe nor witness shall be harmed, and if you do, then indeed, it is a sin for you, and you shall fear God. And God teaches you and God is aware of all things.

Islamic banking

The term “Islamic banking” refers to a system of banking or banking activity that is claimed to be consistent with Islamic laws or principles and guided by Islamic economics. The contemporary movement of Islamic finance is based on the belief that “all forms of interest are riba”, and hence the accounts with given interest rates in the existing banking system is unlawful. Thus, instead of the accounts with given interest rates, Islamic banks provide accounts which offer profit/loss based on the Profit-Sharing principle. The bank in turn purchases assets with your money, which generate returns for the bank. What is understood upon careful review that Islamic finance has its own ways to provide banking service around charging interest to ensure the profitability and sustainability of Islamic banks just coining the word “Islamic” to their system. The coining of the word Islamic may attract and encourage some Muslim customers to do interest free business with them but in reality which is not true that it is Islamic. However, Islamic banking is a novel way to provide banking service but in true sense it is not Islamic as there is no specific reference from the Quran except an assumption that both usury and interest are unlawful in Islam. While there is opportunity for all of us to learn from the Quran that trade and usury are not the same reflecting to the verse 2:275, then how lawful it is from the Quranic point of view to coin the term “Islamic” in the banking system. However, there is no reason to believe that any business with their banking system is unlawful as long as they do not charge excessive interest and are state approved while any notion of doing business with them would be more righteous works than the normal business practice would impose shackles and burdens on us.

Conclusion

Usury is defined as excessive interest and has been forbidden in the Quran. Thus, earning interest and paying interest is perfectly acceptable, as the Quran has not prohibited interest. Per verse 2:282 a loan may involve interest, to at least pay for the cost of the loan to the lender if any, and compensate for any change in the value of the currency over the time of the loan, but should not involve usury.

Interest is an essential component of the financial aspect of an individual or an organization. Individuals may need to save money in a bank, may carry a credit card for convenience, or may borrow and pay interest for an automobile or to own a house. Borrowing money and thus paying interest for business loans is an essential component for business and organizations. Thus paying interest, as long as it is not considered excessive by the standard of the day and community, to a credit card company, to a financial institution for a loan of any kind (business, car, house mortgage) is allowed and perfectly legal from a Quranic point of view. Also earning interest from a financial institution like a bank or bonds or mutual fund is also fine.

However, the practice of usury, unfortunately, is prevalent all over the world with individuals and business engaged in this practice. The unlicensed or illegal moneylenders (mafia being a well-known example) who charge usuryare all over the world. These illegal moneylenders have entirely separate standards for making loans – they charge excessive interest (usury) and usually rely on someone’s life (guarantor) as collateral. The Quran forbids in dealing with usury – borrowing money and paying usury or earning money by charging usury. The Quran specifically states that usury cannot be equated to commerce or taken as a normal business practice.

Some Arabic linguists consider Riba, the Arabic word for interest means any increase, not just large amounts as there are pretty clear signs in the Quran that Muslims are not supposed to take interest in any amount.While there are some linguists who express their view to consider the semantic change in the evolution of word usage, usually to the point that the modern meaning is broader or radically different from the original usage. However, the Quran, which spells out religious laws for our great religion, removes the shackles and burdens imposed on us by the ignorant scholars and religious leaders. Most of the “Muslim” countries have various laws against interest and have sham “interest-free banking” reflecting their ignorance of this simple Quranic truth. Unfortunately, quite a few of those who call themselves Muslims fall victims to the falsehood spread by these religious leaders.

In practical terms as long as we are dealing with any state-licensed institution like a bank, Mortgage Company, Credit Card Company, etc., we are not violating any Quranic commandment as these institutions usually follow the law of the land and do not charge excessive interest. They calculate their interest rate on daily basis considering the status of the economy and the need of the society. However, banking interest regulated by the government is not usury but interest to usury is what profit is to profiteering, and if we deal with the illegal moneylenders who practice usury, we are in violation of clear Quranic commandments.

Peaceful Friday, salaam and God bless.

Tafazzal (6/16/2017)